- tmrw

- Posts

- Compounding Clarity

Compounding Clarity

2025 has been anything but predictable—from trade policy shocks to global rate shifts. In this midyear market breakdown, we unpack the key events shaping portfolios and highlight what smart investors are doing in response. Gain clarity on how to position your investments for the second half of the year with confidence and context.

Hi, Tom here.

Quick reminder: our next Wealth Workshop is on July 9th at 11AM CT. I will be answering your questions live.

If you've found yourself wondering how markets can feel so chaotic, yet your portfolio continues to climb, you're not alone. Today, I'll unpack exactly what's happening, why it matters for your retirement, and how you can keep building clarity amidst the noise.

Let's dive in, starting with one of my favorite insights from Warren Buffett.

“Knowledge builds like compound interest“ - Warren Buffett

That quote has been on my mind lately.

AI is getting insanely good, and I’ve been sitting in my office, talking to clients, writing to you, reading the news, and wondering what the future holds when we have access to all knowledge, at the push of a button.

The stuff we’ve gone through in 2025 feels different, and it is different.

It’s not just me, I’m talking to you guys and clients daily, you guys are saying the same thing.

We’re halfway through 2025, and I’ve got mixed feelings about the year so far.

On one hand, my youngest daughter just learned how to walk, my son is now riding his bike without training wheels, and my oldest graduated from kindergarten. I couldn’t be a prouder father.

Looking at markets, the S&P is tracking toward all-time highs.

Then, I open my iPhone and check the news.

The news cycle is relentless, chaotic, and anxiety-inducing.

Yet, while the events of 2025 have certainly been extreme, it's worth remembering the media's primary goal: to capture our attention in any way possible.

This edition, however, isn't meant to monetize your attention. Rather, it's meant to sharpen your focus on what’s genuinely influencing your portfolio.

We’re halfway through the year. So let’s zoom out and take stock of what’s really been driving markets in 2025.

To understand where we are, lets go down market history lane for context:

Back in 2022, the world felt chaotic. War in Ukraine. Chinese lockdowns. Global supply chains tangled. By midyear, U.S. consumer confidence had collapsed, and investor sentiment with it. That summer was one of the toughest stretches I’ve seen for client conversations—markets were volatile, and the path forward felt impossible, and this was the icing on the cake:

2022 in a nutshell. This small problem roiled the already fragile global supply chain. Source: New York Times.

Then came 2023. Inflation cooled. AI took the spotlight. Markets regained their footing, especially in tech and growth sectors. The optimism was cautious, but it was real.

2024 built on that. Nvidia hit a $2 trillion valuation in February. Economic data showed surprising strength. And a dramatic election year culminated in Trump defeating Biden, which sparked a sharp year-end rally. By December, it was clear we’d just closed the books on two back-to-back years of ~25% market gains.

Which meant one thing heading into 2025: the bar was high. And as investors, we needed to be ready—not just for what we expected, but for everything we didn’t.

The First Half, in Focus

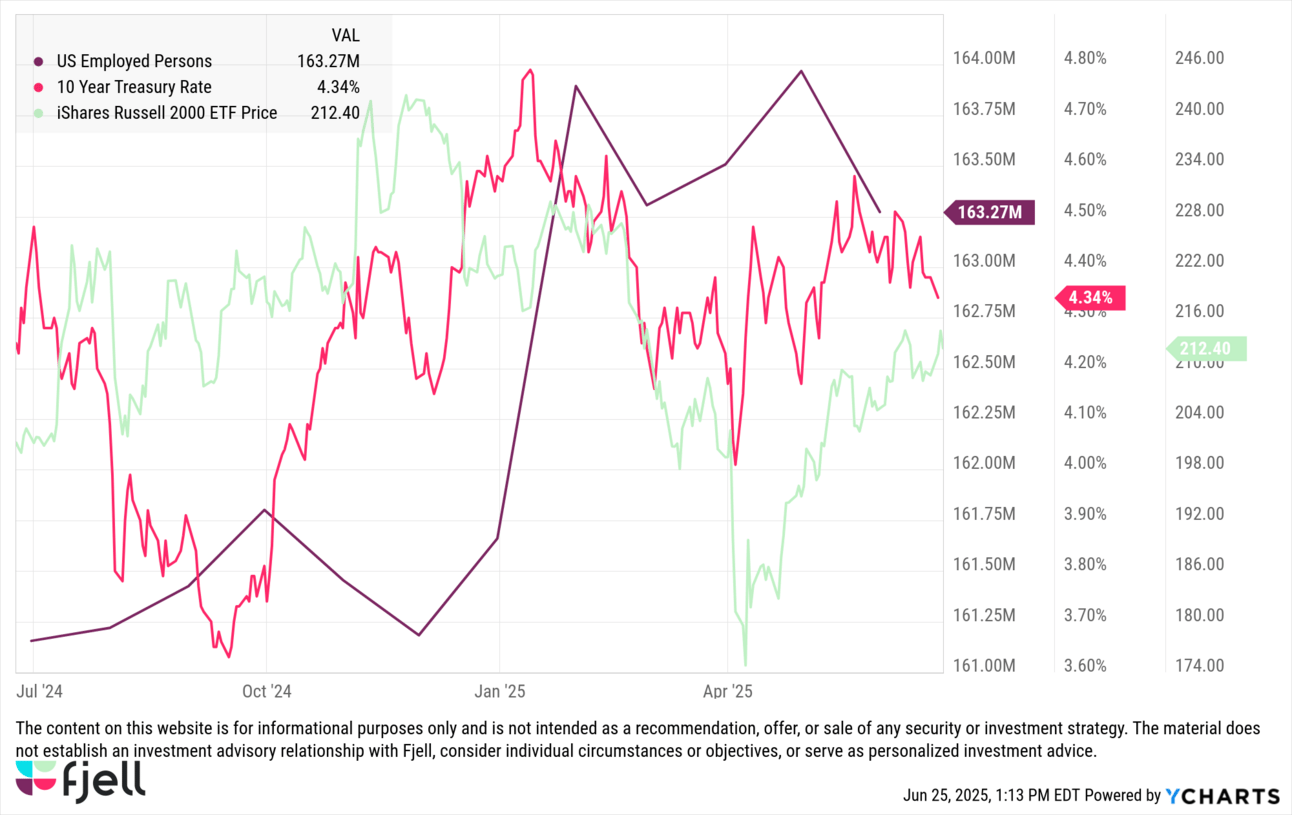

January 4: Jobs Data Surprises

Sometimes good economic news can mean bad market news.

The year kicked off with a stronger-than-expected jobs report. While good news for workers, markets saw higher bond yields spike, pressuring growth stocks that rely heavily on cheap borrowing. It was an early reminder in 2025 that good economic news does not equal good market news, odd as that sounds.

February 1: Trade Policy Returns

Political headlines quickly became market headwinds.

Markets absorbed another surprise when the Trump administration announced new tariffs targeting imports from Canada, Mexico, and China. Global and industrial stocks fell, prompting reviews of US vs International equity exposure.

This was the market’s first real encounter with the new administration’s economic tone, and it wouldn’t be the last.

April 2: “Liberation Day” Tariffs Trigger a Shock

Market discipline was tested.

A sweeping second wave of tariffs hit markets hard, with the S&P 500 falling more than 4%, the steepest single-day drop since 2020. Trust was shattered in markets, leading to companies reporting two earnings outlooks: one with tariffs and one without. Wild.

Times like this reinforce the value of staying prepared and disciplined in your strategy.

April 9: The Bounce

Patience rewarded—again.

Exactly one week later, markets rebounded sharply, nearly 10%, after announcements of temporary tariff relief. Investors who stayed disciplined and held steady through volatility saw significant immediate upside. This bounce ended up being the current bottom.

Patience pays off.

April 25: The AI Story Holds Strong

The investment world got a clear message: AI isn't slowing down.

Apple, Microsoft, Amazon, Alphabet, and Meta all reported earnings, clearly demonstrating resilience and continued growth driven by AI investment, even amid market volatility. Nvidia’s standout results in May further reinforced investor confidence. If anyone had doubts about the staying power of AI, this period put them to rest.

For investors, the takeaway is clear: AI isn't just a headline, it's an enduring investment theme reshaping portfolios for the foreseeable future.

What This All Means for You

The past six months have offered a masterclass in volatility, resilience, and surprise. If you've felt uncertain or frustrated at times, you're not alone. But there's a powerful lesson here: the best portfolios don't chase headlines.

They anticipate them.

As we step into the second half of 2025, take a quick moment to evaluate your own approach:

Are you holding enough liquidity to seize opportunities as they appear?

Are you diversified enough to comfortably withstand unexpected shocks, whether domestic or global?

Do you have a clear, disciplined plan for rebalancing when emotions inevitably test you?

The truth is, no one knows exactly what the next six months hold. There will be more noise, more surprises, and more shifts. But successful investing isn't about guessing the future. It's about steadily compounding your knowledge, preparation, and discipline over time.

Remember what Buffett said at the beginning of this piece: “Knowledge builds like compound interest.”

The investors who thrive aren’t lucky. They’re prepared. They consistently turn knowledge into clarity, and clarity into action.

Stay sharp. Stay balanced. Stay ready.

And if you want to ensure your portfolio is set up to compound wisely, no matter what headlines come next, let’s talk.

Shortly after the April 2 “Liberation Day” tariffs, how much market value did the S&P 500 companies lose in total over the following two days? |

|  |  |

How'd we do this week? |