- tmrw

- Posts

- What Could Go Right

What Could Go Right

This edition explores what happens when years of investing finally begin to work in your favor and your financial life enters a new stage. We explain why recent market gains have made many financial plans obsolete and how to navigate the complexity that prosperity creates. Learn the key steps to move forward with clarity, confidence, and a long-term strategy.

Hi, Tom here.

This is tmrw — a weekly note on how to think, plan, and invest with clarity. Each edition is designed to help you protect your wealth, avoid costly mistakes, and make smarter long-term decisions.

I’m glad you’re here. Let’s get into it.

This year-end has been fascinating.

As many of you know, I am a third generation financial advisor. My grandfather, Cliff, started serving families in 1961 in downtown Fargo, ND. Some of the families we work with today have been with us for decades, through three generations of advisors. It continues to be an incredible run.

We have had a lot of year ends, but this one has been different.

It has been prosperous.

It has been a year that has culminated in what I can only call “when things go right.”

A moment when you open your statements and think, “wow, look how far we have come.”

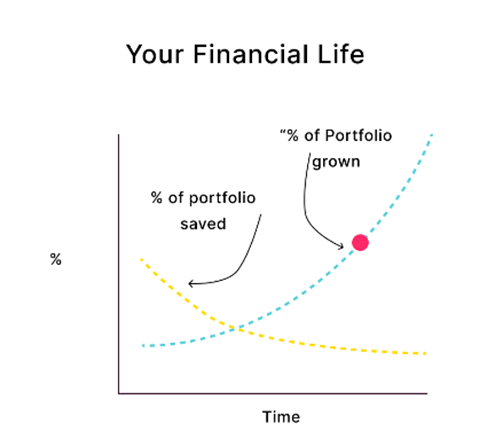

A long time ago, I made this graphic. It is a simple picture of how your money grows over a lifetime.

Yellow Line: Your Contributions | Blue Line: Yearly Portfolio Growth | Pink Dot: Your Retirement

When you are starting out, your savings rate does much of the heavy lifting for you. If you have a $100,000 portfolio and you save $800 a month - your contributions make up about 10% of your portfolio value.

At some point, your contributions and annual growth intersect. This is a key milestone for every investor, it marks the time when you are passively growing your money at the same rate as you are saving it.

From there, your financial life really starts accelerating and your net worth starts growing substantially.

At every step of that journey, you are consuming information, building beliefs, and forming a picture of what a good financial life should look like.

Along the way, most financial content falls into two categories.

Get out of trouble content

Advanced Technical Content

“Get out of trouble” content is the Dave Ramsey, baby steps type of advice. It covers budgeting, debt payoff, and foundation building.

Advanced content is more tactical and specific, like:

10 index funds you need in retirement

5 Social Security mistakes you’re about to make

3 tax moves to do before the year end

The content you consume typically matches where you are at, or where you want to go with your money.

For example, your 30 year old self was learning about what type of budget should you be using while you and your spouse raise your young family. You think “Our simple life in our 20s and how we budgeted just isn’t true anymore, we need a different plan.” So you explore different strategies to budget, save and invest given your new life stage.

Then, if you are 55, and there are rumors about layoffs coming, you are probably thinking “what if that’s me?” “I wonder what type of severance they are giving senior people?” “Should I try to retire early if the severance is good?” “What would I do with the $1.4 million in my 401k?”

While learning about money in the early 2000s is different than today. Today, questions turn into Google searches, YouTube videos, or conversations with AI.

The algorithm's pick what you are searching for and give you more content surrounding your questions. This is how pretty much every modern investor in America learns about their financial life.

When things get serious, they talk with their spouse, friends and advisors.

The progression goes:

Thought → Search → Content → More content → Conversation → Action

Action leads to new and different thoughts or problems to face.

“Wow, honey, we’ve made $250k in our investments this year”

The returns from the market over the past three years have been phenomenal.

More people than you might imagine have made hundreds of thousands, millions, and even tens of millions of dollars over that period. Amidst the political drama, the tension, and the nostalgia for the “good old days,” the markets have rewarded those who stayed invested and took risk.

And something unusual has been happening. You may have noticed it.

Portfolio returns have grown so quickly that many financial plans created just a few years ago already feel obsolete. Portfolios have also grown faster than the available knowledge of what to do with them. The content you find is not keeping pace with your reality.

Which is ironic when you think about the huge increase in AI generated content filling your feeds.

We’ve had many conversations with clients this year that are just different. Conversations laced in prosperity and complexity.

The conversation goes beyond their life and to the life of others, it’s fascinating and propelled only by the incredible back-to-back-to-back returns of the equity markets.

It’s strange to realize you have entered a new stage of your financial life, one that asks different questions than the ones you are used to asking. When this happens, the questions get bigger because the money is bigger, the consequences are bigger, the taxes are bigger, and the possibilities are bigger.

All good things

Large Green Circle: The fruit of decades of investing

Once you realize you are in this green circle stage, the conversations at home change. You talk with your spouse and they are at wondering the same thing. The money is great, but no family member has been here before. You made more money passively in a year than what you made in your 40s working 50 hours a week.

It’s good but a bit unnerving.

Something amazing just happened after decades of hard work, sacrifice, planning, investing, stomach losses, tax planning, and perseverance: what could go right has gone right. You have total financial freedom. And with that freedom, you can start to wonder how you can share freedom to others, or secure that freedom by investing differently.

It’s at this point where the adage starts to come true: what got you here won’t get you there.

You want to steward, to give, to secure, to dream, to go.

This prosperity unlocks new problems to solve, different tax and investment strategies to explore, opportunities to borrow money differently, and to give differently.

Two things for you this week:

I know there are a lot of mid-career readers or folks who got to the game of invest late in life - stay at it. There is no-sense in giving up on saving and investing diligently. Compound interest works, you just need to stick around for your “what could go right” moment.

If this is you, understand the game has changed, in a very good way. Don’t stay the same, play the new game. If you have kids/grands in spot #1, keep encouraging them to do whatever they can to keep investing.

Thanks for your time this week, I am grateful for you.

Life isn’t perfect, but it’s good.

Tom

When you know you need to make a change, start here.

Many families have changed significantly this year. We know because we’ve talked with you. Investing, taxation, inflation, housing, retirement, spending patterns, have all changed. You can feel it, sense it, and know you need to make a change.

Your taxes are too high

You don’t feel your advisor’s fee is justified

You have cash and you don’t know what do to with it

Your investment strategy doesn’t reflect what you want your money do for you

That changes starts with a conversation.

My firm, Fjell Capital, is a fee-only wealth management firm with clients across the U.S. We know what families like yours want and need from their advisors. We created our Strategic Wealth Assessment to help you, interested in change, understand where you are at with taxes, investing, and financial planning and to offer you a roadmap to move forward.

In a simple two-part conversation with our team, we’ll give you clear insight into your balance sheet, your tax picture, your investment strategy, and the opportunities available to you that you may not even know exist.

If you want clarity on how to move forward with confidence, the Strategic Wealth Assessment is the best way I can help you. Your future is worth it.

We make a limited number of these assessments available each month to qualified families.

How helpful was this week’s edition?Comment after you submit. Your feedback helps shape what I write in future editions. |

|  |  |