- tmrw

- Posts

- The Quiet Market That Rules

The Quiet Market That Rules

Stocks continue to rise on the back of AI, government spending, and IPO momentum, but bonds are sending very different signals. Higher yields, sticky inflation, and heavy government debt are reshaping the fixed income landscape. For retirees, understanding bond exposure is critical because fixed income drives cash flow, stability, and diversification. This edition explains why knowing your bond portfolio may be the key to long-term retirement security.

Hi, Tom here.

Welcome to this week’s edition of tmrw, the newsletter built to give you clarity for the financial decisions that matter most. Each week, you’ll get ideas that help you strengthen your plan and retire with confidence.

Watch this week’s episode of Wealth Workshop:

Each week, we break down what’s happening in the world, how it affects your money, and what to do next.

This week’s focus: Cashflow for business owners, and why it’s hard.

I will walk you through a simple framework on the whiteboard that shows what business owner’s cashflow looks like, why it’s hard to build wealth as an owner, and what to do about it.

Have a question that you want answered?

Missed last week’s episode?

The jobs report last week was, to put it bluntly, ugly.

167 million Americans worked, and the economy produced just 22,000 new jobs. Then this week, the BLS quietly revised last year’s job creation lower… by 900,000.

But who cares, the stock market keeps notching new all-time highs.

Well, your portfolio does, just not your equities. Stocks are still riding at all-time highs thanks to the massive amount of liquidity in the financial system. Between U.S. companies spending heavily on AI (look know further than yesterdays $300 billion Oracle cloud deal), the federal government keeping up its spending habits, and a steady pipeline of unicorn IPOs, it is no surprise to wake up and see equities charging ahead.

In the short run, stocks look great. But trouble is brewing in bonds.

Check out this headline: “German Bund Yields Extend Rise; 30-Year Yield at Highest Since 2011.”

Here at home, long-term Treasury yields remain elevated, even with the futures market implying a near certainty of a Fed rate cut in September.

Why?

Because markets see sticky inflation, heavy government borrowing, and questions about demand for U.S. debt and the health of the economy.

So while equities shine on the surface, other markets are telling a different story.

“Hey, honey, the kids just texted us…”

“They asked us if we can come down for Halloween and go trick or treating. Can we go?”

In retirement, those spontaneous questions are the ones that matter:

A trip to see family.

A weekend away with friends.

A special donation to your church or alma mater.

The ability to always say yes to these things comes down to one thing: cash flow.

And in all my years managing money, I’ve never met a retiree who didn’t want more of it.

That’s where bonds come in. They’re the forgotten hero in many portfolios. Bonds don’t dominate headlines like equities, but they quietly provide the ballast that keeps a retirement plan steady.

Bonds are the income-producing assets that sit prominently on balance sheets of most people in retirement, and they play three critical roles in portfolios that are used for retirement:

Capital Preservation – providing ballast in tough times.

Current Income – generating the steady cash flow you need today.

Equity Diversification – serving as the pool you can rebalance from when stocks fall.

The roles are simple, but how you optimize your fixed income is harder than it looks . Unless you look closely at your bond allocation, you may not know whether your fixed income is providing the ballast, income, or diversification benefits you think it is.

To illustrate, let’s look at the bond index itself: the Bloomberg U.S. Aggregate Bond Index, represented by the iShares Core U.S. Agg ETF (AGG).

AGG Sector Exposure

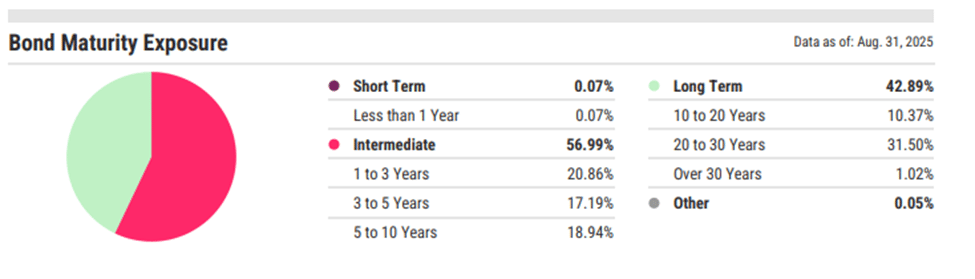

AGG Maturity Exposure

AGG is filled with government debt, which means Washington’s borrowing habits shape a large portion of the index. On top of that, more than half of AGG sits in intermediate maturities and over 40 percent in long maturities, which opens up investors to significant interest rate risk.

And here is where the AGG is different from the S&P 500. This is key, read closely:

The highest performing stocks in the S&P, overtime, become higher weights in the index. In equity investing, winners typically keep winning. But in the AGG, the biggest borrowers (issuers) become the biggest weights in the index.

And who is the biggest issuer of debt in the U.S.? The U.S. government.

Here is how long-term US debt has performed over the past five years, shown through the iShares 20+ Year Treasury Bond ETF (TLT):

Interest rate risk, credit spreads, and tax treatment all matter in your fixed income portfolio. A high-quality municipal bond ladder looks very different from a long-duration Treasury portfolio, and both behave differently from corporate debt.

Knowing your fixed income portfolio means knowing your entire portfolio. When you know what you own, tax planning, cash flow planning, and retirement itself all become easier and less stressful.

It’s impossible to be a great investor if you do not know what you own.

“I would never own less than 80 percent equity.”

Larry Fink of BlackRock built the largest asset manager in the world. He pioneered indexing and ETFs, making it possible for investors to build low-cost, tax-efficient portfolios.

When I first heard him say this, I understood what he meant. Equity investing is where compounding happens, and most people are best suited for a majority allocation to stocks. Risk taking over the long term is good. But what struck me most was the other side of his point.

I thought to myself: most people will miss the importance of the remaining 20 percent.

From my experience, investors know how much cash they hold and follow the stock market closely, yet remain unclear about their fixed income. The bond market is, by design, quieter. It requires a different mindset than equities, where the goal is to take risk and grow. I get why it’s easy to overlook this part of a portfolio.

But fixed income is the “smart money” on Wall Street. It doesn’t make people rich, it keeps them rich. The equity market gets the headlines, but the bond market quietly sets the rules of the game.

And right now, it is sending signals. Yields remain higher than expected. Credit spreads are shifting. The Fed is preparing to cut, yet long-term rates refuse to move.

All of this should make you ask: are my bonds still doing their job?

As we head into year end, take a close look at your fixed income allocation. Bonds may be boring, but they often decide whether you can keep saying yes in retirement.

Thanks for reading this week,

Tom

Before You Go, A Resource Built For You:

I love writing this newsletter for you, and every story and perspective I share comes directly from the work we do at my firm, Fjell Capital.

We are a fee-only wealth management firm and we’ve built what I believe is one of the most valuable resources available for you, our Strategic Wealth Assessment.

The Strategic Wealth Assessment aims to give you a 360° view of your financial life. Including where you stand, potential risks, and the potential opportunities to strengthen it. It’s the first step toward a coordinated strategy that seeks to protect your wealth, fund your goals, and preserve your legacy.

It’s a $2,000 value, available at no cost for qualified readers of tmrw.

Your personalized Strategic Wealth Assessment

A clear picture of your strengths, risks, and opportunities

Because your retirement demands clarity.

We make a limited number of Strategic Wealth Assessments available each month to qualified families. It’s a $2,000 value, with no cost if you are serious about your financial future.

How helpful was this week’s edition?Comment after you submit. Your feedback helps shape what I write in future editions. |

|  |  |