- tmrw

- Posts

- The Complexity Curve

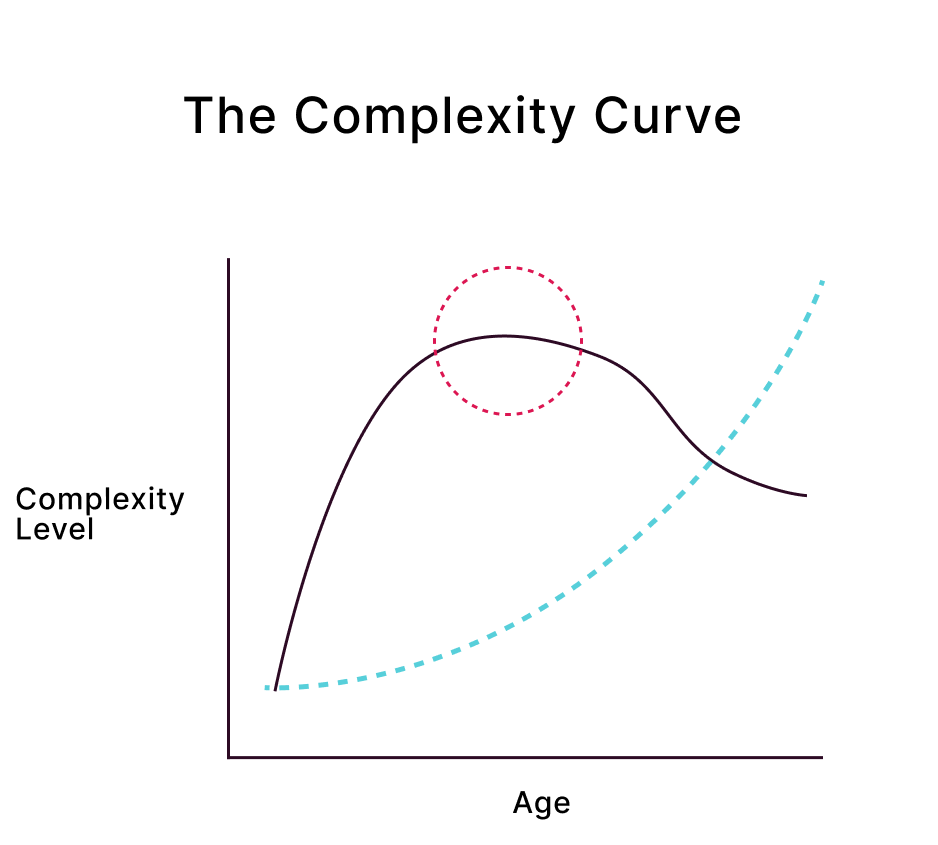

The Complexity Curve

Discover The Complexity Curve in this week's edition of tmrw—why financial lives peak in complexity before retirement and how to simplify your accounts, taxes, and strategy for a clearer, more confident financial future.

Hi, Tom here.

Welcome to this week’s edition of tmrw, the newsletter built to give you clarity for the financial decisions that matter most. Each week, you’ll get ideas that help you strengthen your plan and retire with confidence.

Check out this week’s video:

We had a short break in production, but we’re back.

This week, I walk through how AI could reshape both portfolios and retirements,

and what it means for investors like you.

Have a question that you want answered? Submit them here

Your financial life flows through a series of accounts, where you save, invest, and spend.

You earn money, spend it, and invest what’s left. Each stage of life adds another account—and another layer of complexity.

Over the years, I’ve noticed a pattern as I’ve helped successful families in the 50s gear up for retirement. I call it the Complexity Curve.

Here is how it plays out:

You start your career with a checking account and a credit card. You get your first 401k at your first job, and from that point on, you begin accumulating more accounts, more investments, more tax opportunities, more kids spending your money, more of everything.

At some point, it reaches a culmination of complexity where you say:

“Something needs to change. I have way too much going on. This is confusing. Between me, my spouse, and three kids, we’re all spending money from the same pot. I have too many investment accounts. I don’t know what my advisor is doing. And now my company just announced more layoffs are coming in 2026. I just want to retire in six years.”

This conversation is often what sparks real progress. It is the moment people push through the complexity and begin building a simpler and more powerful financial life.

Here is what this curve looks like:

Dark Purple Line: Complexity Curve | Blue Line: Net Worth

The idea behind the curve is this:

At some point, financial lives get big enough and complex enough that it becomes challenging to organize and conceptualize your future, even though you’ve never had more money.

Typically, as time goes on, the complexity level decreases, but only after intentional effort. I also overlayed a typical Net Worth Curve (the blue line) on the curve so you can get a sense of an ideal situation looks like for a couple heading into retirement, that being decreasing complexity and increasing growth and passive retirement income.

Picture this: you’re in your 50s, have been married for decades, and have had a successful career as a Sales VP in a large manufacturing company. Your wife was a career educator. You have two kids in college.

Here is what your financial life looks like.

2 Traditional IRAs

1 Roth IRA

2 401(k)s

1 457(b) Plan

2 Term Life Insurance Policies

1 Brokerage Account

1 Small Robinhood trading account

2 Checking Accounts

2 Savings Accounts

2 Health Savings Accounts

2 529 Plans

You know there are a lot of accounts (18 to be exact), but each serves a purpose. The question you are probably asking is “well, what should each account’s purpose be and how do I best leverage the unique benefits of each?”

I’ve always erred on the side of simplicity when it comes to growing wealth personally. I also try to distill complexity for clients as they move through this period, since it can be hard to see a path forward with this level of complexity. But here’s the deal, when it comes to retirement planning, I actually prefer to see a large number of accounts on a family’s balance sheet for a simple reason.

Tax Diversity.

For the families we serve and for many high net worth families, taxes are the single largest bill in retirement and can easily total millions over a three decade retirement

A wide mix of account types creates opportunities. You can better manage your income, your withdrawals, and your long-term tax strategy. That complexity, if coordinated correctly, can help you compound your assets faster.

Here’s why: a trend amongst policy makers in the last 6 years or so has been to increase the value of retirement accounts during the account holder’s life (yours) while making them less valuable to non-spouse inheritors.

More account types. Different rules for you and your inheritors. More changes. More complexity. And more opportunity.

For example, retirees will be able to contribute to HSAs starting in 2026. A big project for us next year will be how to fold this into client’s tax and investment plans.

Let’s keep pushing forward.

“Great, Tom. This makes a lot of sense. This is me. Where do I start to get out of peak complexity?”

Again, assuming you are this person with about 18 accounts between you and your spouse, here’s how I would start to organize and think through it.

First, let’s get some important dates on the table for your future financial life.

Retirement date for you and your spouse

Medicare eligibility date for both of you

Social Security start dates

Required Minimum Distribution (RMD) dates

Your estimated life expectancy

Your spouse’s estimated life expectancy

Some of these are flexible. You can choose when to retire or when to draw Social Security. Others are fixed, like Medicare eligibility and RMDs. And some, like life expectancy, only God knows. Together, these dates form the foundation of your retirement timeline.

Once you know these dates, you can forecast what your taxable income will look like as you move through retirement.

For example, let’s say your spouse retires at 61 and you at 64. Once you reach 65, Medicare eligibility can significantly reduce healthcare premiums, saving thousands per year. Social Security payments will begin to add taxable income, with up to 85% taxed for many high earners. Then, at age 75, RMDs begin. That’s another source of taxable income, whether you need the money or not.

Each of these milestones permanently changes your financial picture. That is why planning around them rather than reacting to them is key.

Now we have the accounts and the dates. This is where understanding the rules of the game comes together.

Let’s take this home.

Much of retirement planning can be summed up with this: maximize what you have, avoid debt, be tax smart, and maintain a healthy withdrawal rate.

And have fun.

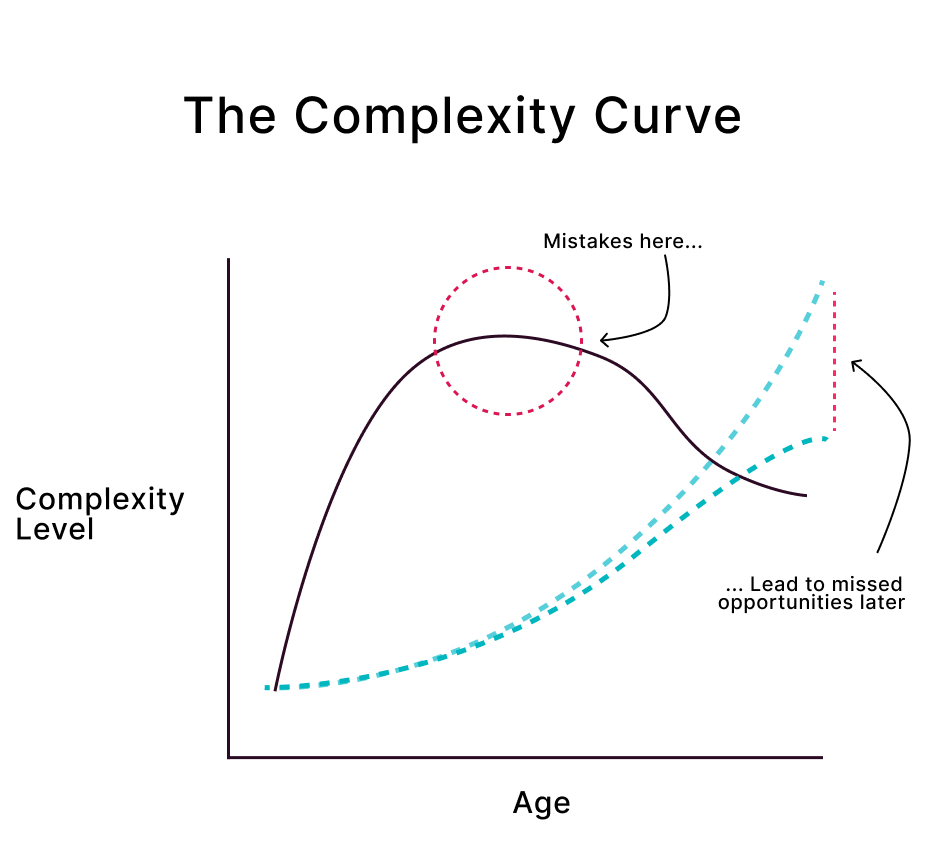

When your financial life reaches peak complexity, you want to ensure you are making great decisions and enjoying what you’ve worked so hard to build. What you do not want is to miss opportunities that allow you to invest more of your income and, in turn, stunt your long-term wealth creation.

Here is what happens when you make mistakes at peak complexity. The consequences may seem small at first but compound over time, leading to a permanently stunted nest egg.

The rules of retirement keep changing. For example, retirees will be able to contribute to HSAs starting in 2026.

That’s another account and tax problem to track.

A lot of you are around the time of peak complexity, life is busy, kids are growing up, your career is advancing, you’ve never had more money.

All good things, but don’t let this season convince you into believing you are too busy to take charge of the complexity because here is what can happen: when you have all the time in the world, you’ll have wished you did a few things better in the 2020s.

So do them now.

Thanks for your time this week.

Tom

Before You Go, A Resource Built For You:

I love writing this newsletter for you, and every story and perspective I share comes directly from the work we do at Fjell Capital.

We’re a fee-only wealth management firm, and one of the most valuable ways we help families is through our Strategic Wealth Assessment— a guided, advisor-led process that gives you a complete picture of your financial life.

This isn’t a questionnaire, a self-assessment, or an unhelpful generic PDF built for the masses. It’s a two-part, collaborative session with our team, starting with clarity and ending with strategy. It’s designed to help you see where you stand, uncover risks and opportunities, and outline your next steps toward a stronger retirement plan.

It’s a $2,000 value, available at no cost for qualified readers of tmrw.

Your personalized Strategic Wealth Assessment

Your custom roadmap, built with our team

If you want clarity on how today’s changing tax laws and markets could affect your retirement plan, our Strategic Wealth Assessment gives you personalized insights to avoid what we discussed today.

Yes, this takes time from your end, and time from us, but’s it’s the best thing I have to help you build a better financial future.

We make a limited number of these assessments available each month to qualified families. It’s a $2,000 value, with no cost if you’re serious about your financial future.

How helpful was this week’s edition?Comment after you submit. Your feedback helps shape what I write in future editions. |

|  |  |