- tmrw

- Posts

- Oracle’s Comeback and What It Means for Investors

Oracle’s Comeback and What It Means for Investors

Discover how Oracle’s comeback through AI and TikTok reveals powerful lessons for investors approaching retirement. Learn why shifting from earner to capital allocator creates new opportunities, freedom, and long-term wealth.

Hi, Tom here.

Welcome to this week’s edition of tmrw, the newsletter built to give you clarity for the financial decisions that matter most. Each week, you’ll get ideas that help you strengthen your plan and retire with confidence.

Before we get into this edition, I want to pause and acknowledge the difficult moment we’re experiencing as a country.

Last week was tragic.

Rather than share my personal thoughts, I want to objectively tell you where everyday Americans, like you and me, go to fundamentally disagree, yet do so in a productive, meaningful way.

The markets.

At the core of every investment decision you’ve made in your life (mine included) is one of disagreement.

Every time you buy, a person is on the other side selling you their shares in exchange for your cash.

Every time you sell, there is someone who thinks it’s better to buy and exchanges their cash for your investment.

You hit the green button, they hit the red button. One thinks it’s going up, the other down. Roughly 60 million such transactions happen on the New York Stock Exchange alone each day, a colossal show of fundamental disagreement.

It’s beyond a common occurrence in our country yet there is also a deep unity when buyers and sellers come together to transact, understanding that both sides are free to make their decision.

This unspoken pact of peaceful transacting has lead our country, and tens of millions of foreign investors, to unbelievable prosperity, and freedom.

I deeply care about freedom, it’s the ultimate core value of Fjell Capital. But aside from my personal desire for freedom, seeking freedom has been my lived experience as a wealth manager.

I’ve worked with clients who span the political spectrum over the past 11 years, and in the deepest conversations that happen in the walls of my office—cancer diagnosis, forced retirements, suicide, financial tragedy, miscarriages—everyone deeply wants the same things:

Good health

Financial stability

Freedom to live life on their terms

Regardless of who they are, who they voted for, or what they believe.

I appreciate you. I am praying for you and your family today, and am glad you are part of the tmrw community.

Now, I want to share with you a recent story of an incredible comeback. I hope it provides a dose of hope and perspective at a much-needed time.

Liquidity gives you the flexibility to create cash flow when you need it.

Strong cash flow helps you meet your monthly obligations, but more importantly, it gives you the flexibility to seize opportunities as they arise.

I want to share my favorite investing story of 2025 so far. It captures everything I believe and write about when it comes to building wealth. It’s a good old-fashioned American comeback story. This is why you invest, why you never give up, and why you always keep pushing forward in your financial life.

The main character? Oracle.

You might be thinking, “Oracle? The old-school tech company?”

Yes, that Oracle.

Here’s how it played out:

TikTok is one of the most powerful and largest social media platforms in the world. 136m American’s use it every month and a staggering 82% of Gen Z’s have profiles.

And, it’s Chinese owned.

Given the tense relationship between the U.S. and China, along with TikTok’s massive growth, the U.S. government told TikTok it had to either abandon the U.S. market or be sold to a group of American investors.

TikTok choose to sell and its U.S. business was suddenly for sale. Put another way, this became a once in a lifetime opportunity for someone to buy the attention of an entire generation.

When the news broke, a cue of buyers formed, staring down massive scale, attention, and profits.

Back to Oracle.

Oracle, just a few years ago, found itself as an extremely well run tech company that was behind.

Microsoft, Google, Amazon were winning the cloud infrastructure race, which at the time, was where the hyperscale growth was occurring.

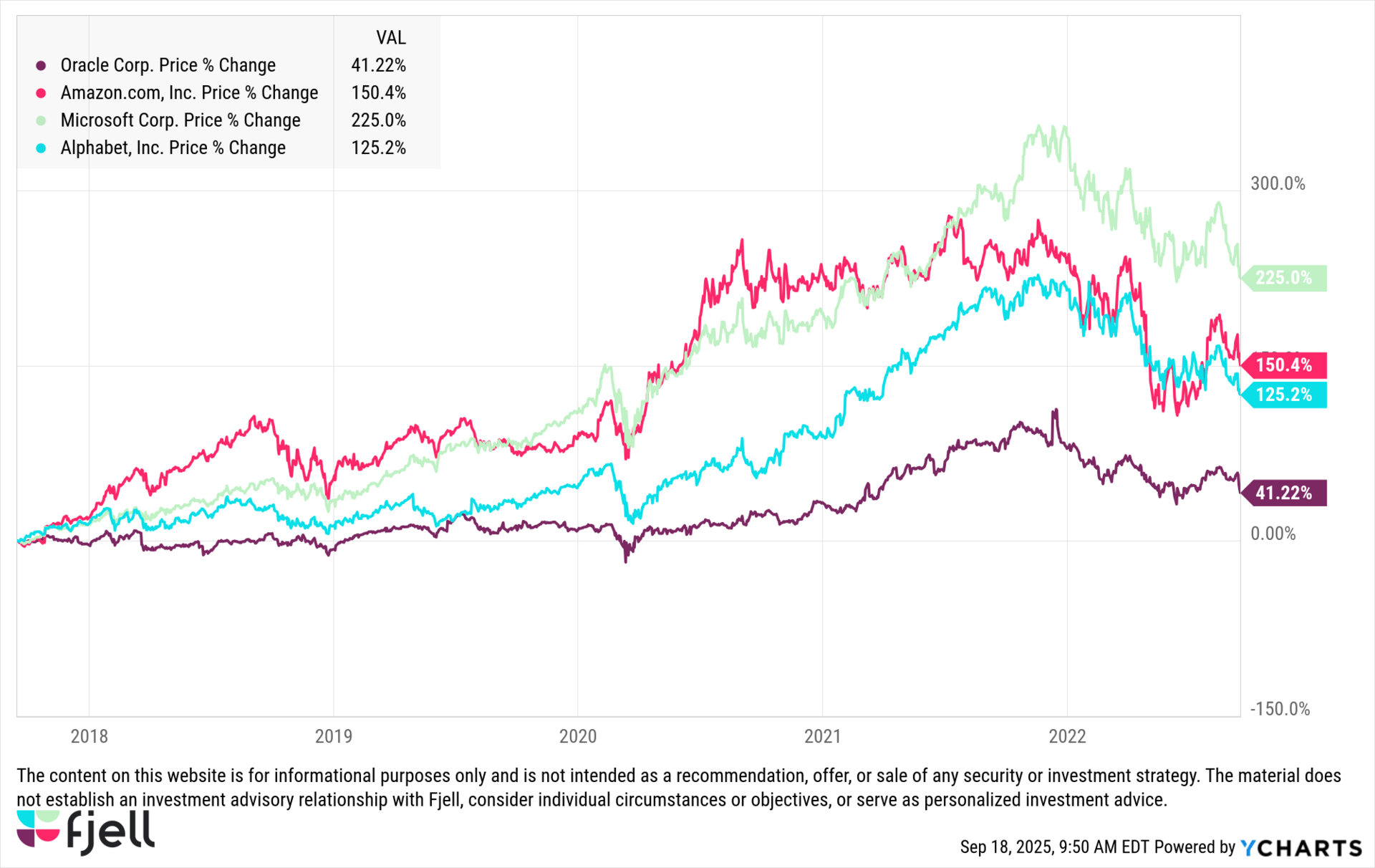

Oracle’s 5 Year Performance, ending on Sept 18, 2022

They had a fantastic and sticky customer base but they found themselves losing in this key battle ground.

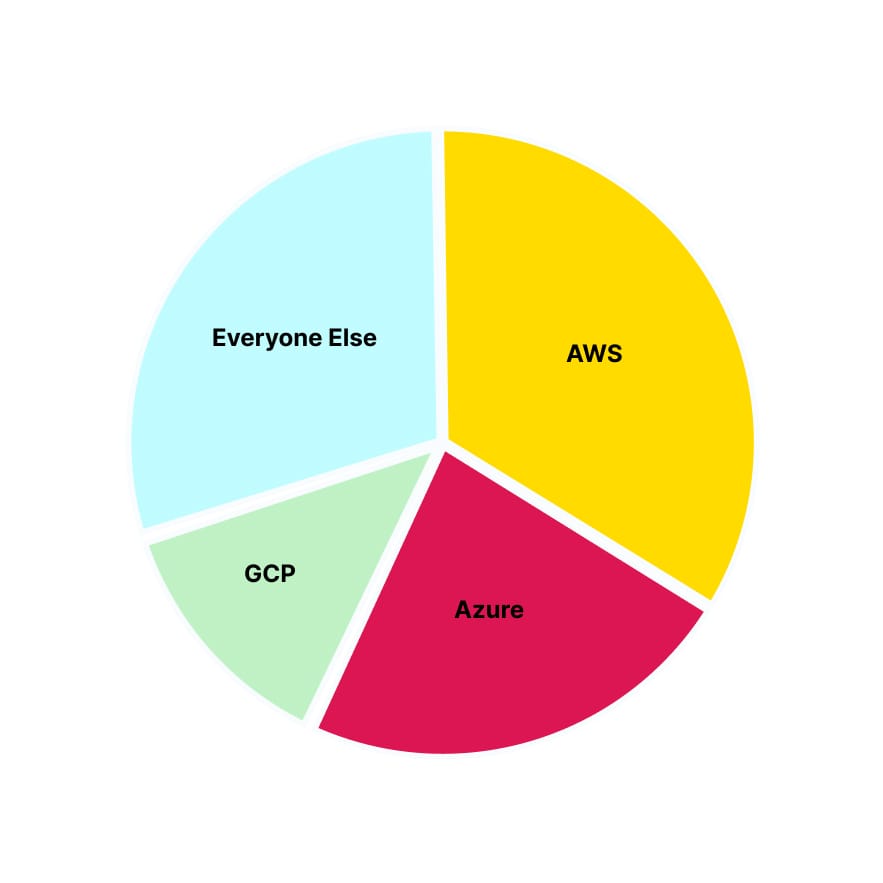

Here is a chart of roughly the market share of the cloud business: Amazon (AWS), Microsoft (Azure), and Google (GCP) had 2/3s of the market, and everyone else, Oracle included, were fighting for scraps. At the time, Oracle had under 5% market share.

Then, everything changed with the release of ChatGPT in November 2022.

The focus of the technology world moved from cloud computing to artificial intelligence. All the big cloud players—Amazon, Microsoft, and Google—were selling cloud services to businesses eager to take part in the AI revolution. At the same time, they were all investing heavily in their own AI ambitions.

This is where the story gets interesting.

OpenAI, a new and fast-growing player in the market, realized that it did not want to keep using cloud services from competitors like Amazon, Microsoft, or Google. Every dollar spent with them could potentially be used against OpenAI’s own future. Instead, OpenAI needed a partner who would not compete directly with its AI efforts, but who could deliver the stability and performance required for hyper-growth.

Oracle became that partner.

And the deal they struck? Incredible.

A $300b, five-year cloud partnership with OpenAI.

While this partnership was formally announced recently, it was undoubtedly in development for months beforehand.

As Oracle was working through the cloud deal with OpenAI, their founder, Larry Ellison, was well aware, and made it known to the U.S. government, that his company was the in the perfect position to lead the investment in TikTok.

Ellison understood that Microsoft owns LinkedIn, Meta controls Facebook and Instagram, Google has YouTube, and xAI operates X. Each of these companies already had massive social media holdings, which meant the government would almost certainly not approve their bids.

Oracle, on the other hand, had everything the government valued for this deal: staying power, long-term management ability, the right scale and experience, and most importantly, the liquidity to make such a massive investment possible.

Oracle was ultimately selected to lead the investment group, alongside Andreessen Horowitz and Silver Lake.

I can only imagine what it must have been like on the Oracle executive team, knowing they were positioning the company for a historic cloud partnership and were also in the running to secure a once-in-a-generation social media platform.

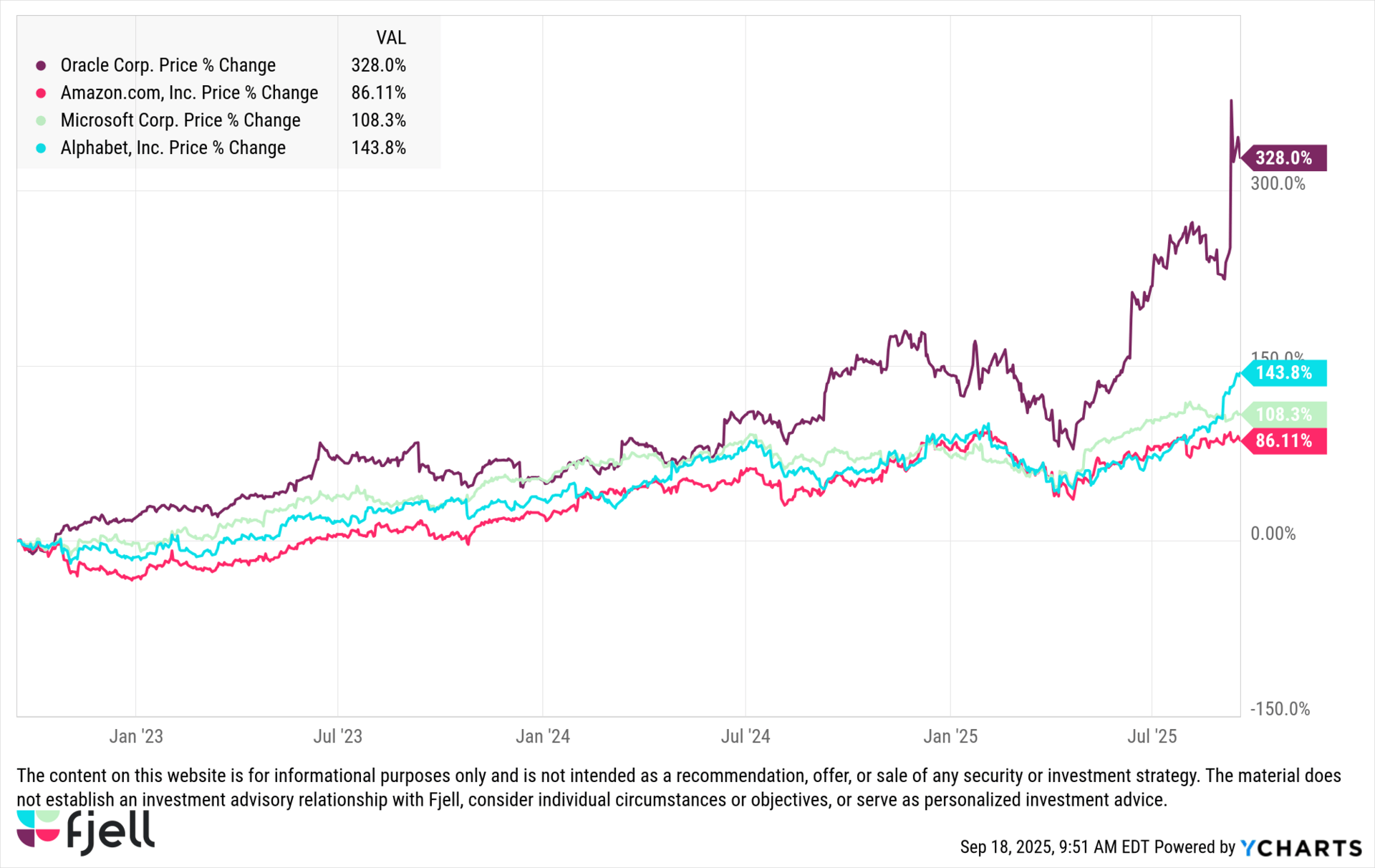

When you look at Oracle’s progress over the last three years, it shows what can happen when you are at the right place at the right time, with liquidity and wherewithal to act.

Oracle’s 3 year Performance

As the saying goes: You reap what you sow.

As you hit your 50s, 60s and 70s, your role in your financial life evolves.

You make the shift from someone who earns income through work to someone who allocates capital—putting your money to work in investments that generate income for you.

With this change, the economy, the Fed, markets, opportunities, and your relationship to risk all start to look and feel different. Your needs and strategy evolve.

Oracle was behind, and for years, investors treated Oracle as a company well past its prime.

But Oracle had other plans. When artificial intelligence emerged in a big way, Oracle saw an opening others couldn’t execute on. They moved quickly, forging one of the biggest deals in business history.

Meanwhile, with the political discourse surrounding a Chinese-owned social media network used by 100m plus Americans, they knew they had things other companies didn’t have: stable management, excellent operations, capacity for the deal, and liquidity.

The worked hard and smart, they played from behind for years, they took advantage of opportunities, and they caught up.

The story of Oracle to me is deeply inspiring. It’s an American story of how you can be incredibly successful, fall behind, and still win big.

As you transition into your role as a capital allocator in retirement, understand this, opportunities will present themselves to you and your family in ways you cannot imagine. That is the true brilliance of being an investor in the US.

We are at the pinnacle of innovation and have hundreds of amazing companies to choose from. There’s never been a better time to be an investor. Oracle demonstrated what’s possible, and your retirement can too.

Thanks for your time this week.

Tom

Before You Go, A Resource Built For You:

I love writing this newsletter for you, and every story and perspective I share comes directly from the work we do at my firm, Fjell Capital.

We are a fee-only wealth management firm and we’ve built what I believe is one of the most valuable resources available for you, our Strategic Wealth Assessment.

The Strategic Wealth Assessment aims to give you a 360° view of your financial life. Including where you stand, potential risks, and the potential opportunities to strengthen it. It’s the first step toward a coordinated strategy that seeks to protect your wealth, fund your goals, and preserve your legacy.

It’s a $2,000 value, available at no cost for qualified readers of tmrw.

Your personalized Strategic Wealth Assessment

A clear picture of your strengths, risks, and opportunities

Because your retirement demands clarity.

We make a limited number of Strategic Wealth Assessments available each month to qualified families. It’s a $2,000 value, with no cost if you are serious about your financial future.

How helpful was this week’s edition?Comment after you submit. Your feedback helps shape what I write in future editions. |

|  |  |