- tmrw

- Posts

- Decision Compounding

Decision Compounding

This edition explores how regret, compounding, and daily decisions shape long-term financial outcomes. Rather than focusing on missed opportunities, it examines why working on the right financial decisions at the right time matters more than chasing performance. A reflection on the intersection of investing, behavior, and judgment for business owners and families navigating complex financial lives.

This is tmrw — a weekly note on money, decisions, and what tends to matter over time.

This week, I’ve been thinking about compounding, regret, and the tension between doing the right work today and knowing what actually matters in the first place.

Let’s call a spade a spade:

Pretty much every person can look back and say, “I wish I had done this one thing earlier in life. It would have changed everything.”

The house you could’ve bought. The stock you missed out on. The business you could have started. The real estate deal that went far better than you expected. The job that could have led you down a completely different career path.

The feeling underneath all of it is the same: what could have been.

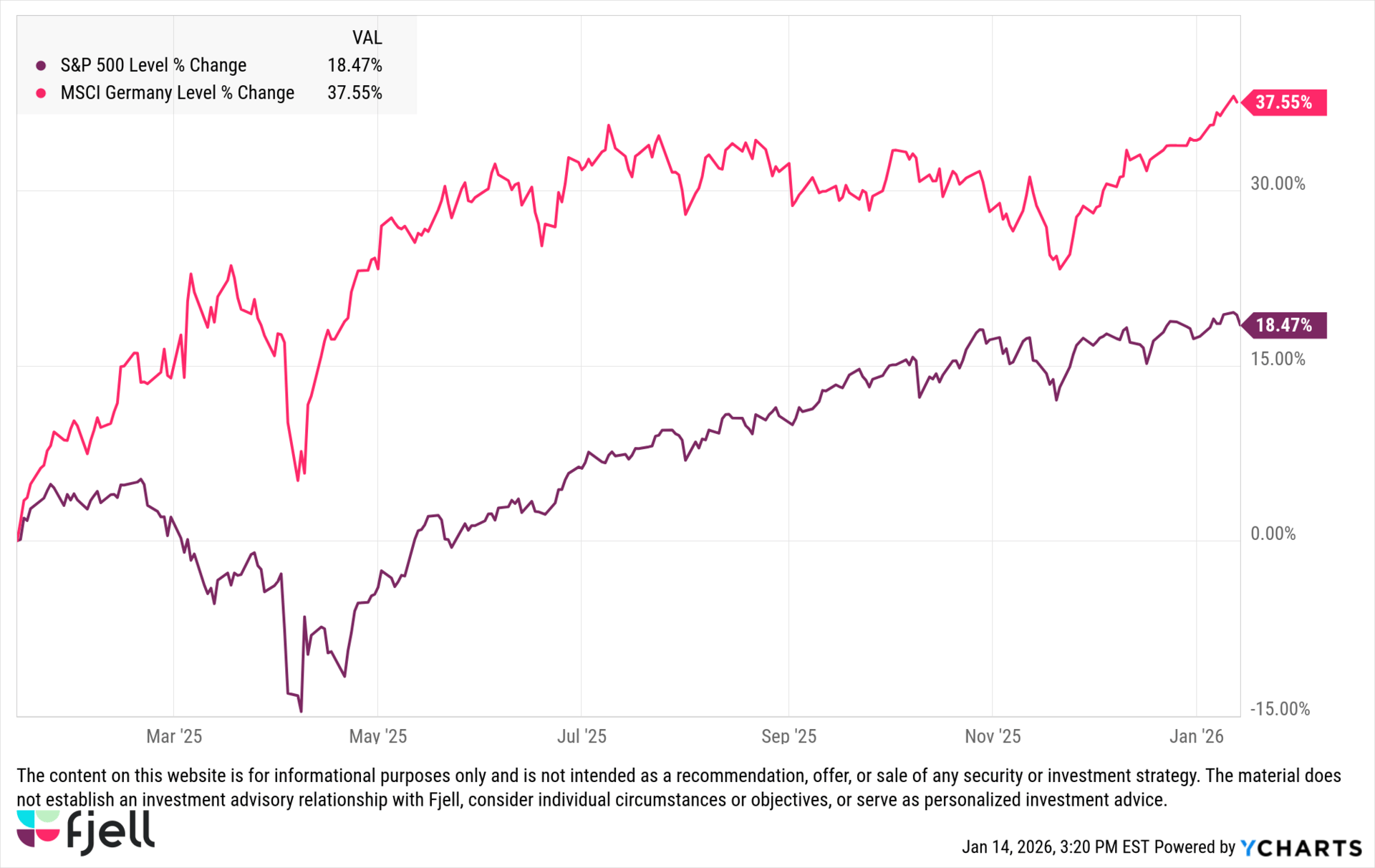

I shared a chart last week showing how the German stock market, year over year, had nearly twice the performance of the U.S. market.

MSCI Germany vs S&P 500

When tracking the various markets over the past year and seeing how German markets closed out the year, I certainly felt a touch of “I wish I had allocated more.”

That feeling is all too familiar: the quick round trip from the head, to the stomach, to the heart.

Regret.

And it’s a dangerous feeling, because it can and does drive bad behavior.

I have my own burgeoning relationship with regret. Not that I am regretful, but the miles of life are wearing on. I have had some painful conversations with myself about what could have been if things were just slightly different. If I had handled conversations better, invested differently, invested time differently, handled certain relationships better.

When reviewing markets at the end of the year and seeing where the German stock market ultimately landed, it becomes clear that everyone made a choice. Either go all in overseas or not.

Hardly anyone went all in. The asset flows into the MSCI German ETF, EWG, year over year are about $481 million, with the total AUM of the fund at $1.81 billion. In the scope of global markets, that is peanuts. Most U.S. investors likely had to “settle” for the blended returns of U.S. equity and fixed income.

But the past is the past, it’s impossible to change decisions already made.

I teed this up on January 8th in our first edition of the year, when I wrote about why a defensive mindset in 2026 is a useful way to frame the year ahead:

“None of these in a vacuum will break you overnight, but mistakes compound just like money… Financial mistakes often don’t show their full consequences for years, sometimes decades.”

“Missing” one year of great returns from a relatively obscure market for U.S. investors is not going to take anyone out, but still, the point stands. Regret is part of every investor’s psyche. You have heard that fear and greed move markets. From my experience, those strong emotions often come from regret.

It’s one thing to read about regret. It’s another thing entirely to walk through the humility required when mistakes are realized and internalized, and make the opposite trip, from your heart, to your stomach, to your head.

Life is amazingly mundane. Eat, sleep, go to work, hang out with family and friends. Every day. Yet in the mundane, is a set of complex choices that involve money, driven by a desire to be free from time constraints, work, certain relationships, dreams to chase down, trips to take, etc.

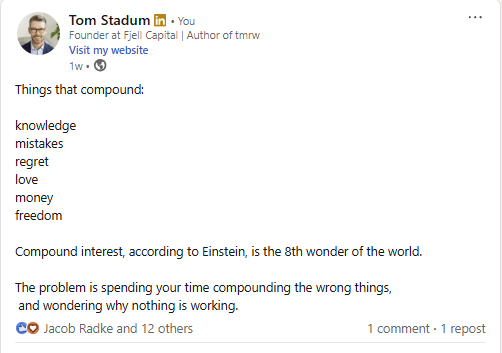

Everything compounds. What compounds is a choice made daily.

Over the years, I have seen people carry a deep sense of urgency about the future. What is working, what needs improvement to get to the end destination, and how to enjoy the journey along the way. Patterns emerge in how each family builds their financial life, shaped by who they are as people, the circumstances of their lives, the economic environment around them, and their tolerance for risk.

As life compounds, and as assets compound, coordination and execution of a plan strangely get both easier and harder. Retirement, for example, is easier to conceptualize when you are close to it, yet as you get close, risk changes due to what your balance sheet looks like. For better or worse, things compound, and eventually, it will bear fruit.

I wrote on LinkedIn a few weeks back about the things that compound.

It all compounds.

What we’ve noticed over the years, working with hundreds of families, is the importance of making great real-time financial decisions today. Financial plans aren’t one-time documents you print off with your advisor every few years. They’re the cumulative result of decisions made consistently over time. This is the game, whether you want to call it or not.

Today is the day.

The last two editions were about compounding assets in international and U.S. markets. None of that matters if there is not an allocation, or a big enough allocation there for it to matter.

The hard part in all of this is that no one plays this game, or any game, perfectly.

Here is the secret: “the game” was not designed to be played perfectly. Mistakes are inevitable, and they are usually only obvious in hindsight. The past is what it is. The future is the future. Today is the only controllable.

Here’s the tension, what work should get done today?

Should you update your estate plan, or focus on tax strategy this quarter? Should you take that meeting with a real estate contact, or revisit your insurance coverage?

There’s always work to be done, and it can’t all be done in a day. It’s not supposed to be.

As a business owner with a relatively complicated financial life, the best way I have made sense of this dilemma is through relationships with people who are smarter in their given domain and can execute faster and better than I can. I have the toolbox, and they use the tools in ways I cannot. They know my life, my business, and our objectives. Between raising three kids, investing professionally, serving clients as their fiduciary, and keeping the business on the right trajectory, nothing works without the right people involved. I hire teammates who can work when I cannot, in areas where I am not competent, and I accept that everything cannot be done at once. What matters is that year over year, the work is being done at an increasingly high standard.

There’s how compounding works on paper, and there’s how it works in life: brick by brick.

Compounding in reality is strange, where individual days don’t seem to matter much, yet over time they matter enormously. Without doing the right work consistently, you end up compounding the wrong things.

As the old saying goes, the only free lunch on Wall Street is diversification. Everything else costs either money or time, and it all compounds.

If you’d like to talk through how this applies to your own financial life, you can learn more about our work at Fjell Capital here.

And if you found this edition useful, let me in the poll below or reply with a quick note—I read every response.

More next week.

How helpful was this week’s edition?Comment after you submit. Your feedback helps shape what I write in future editions. |

|  |  |